are political contributions tax deductible for a business

You can only claim deductions for contributions made to qualifying organizations. Contributions or expenditures made by a taxpayer engaged in a trade or business designed to encourage the public to register and vote in federal state and local elections and to contribute.

What You Should Know About Donating To A Political Party Taxes Polston Tax

These business contributions to the political organizations are not.

. Businesses cannot deduct contributions they make to political candidates and parties or expenses related to political campaigns. The answer is no donations to political candidates are not tax deductible on your personal or business tax return. It clearly states that these donations are not tax-deductible.

When election season rolls around it can seem like news and. The IRS is very clear that money contributed to a politician or political party cant be deducted from your taxes. Its Written Into the Tax Code The Internal Revenue Service IRS also specifically says.

This contribution is eligible for deduction while computing the total income of. In a nutshell the quick answer to the question Are political contributions deductible is no. If youre self-employed however you can deduct the cost of any supplies or services you donate to a.

Are political donations tax-deductible for business. And if you check the box when filling out. A corporation may deduct qualified contributions of up to 25 percent.

Your business cant deduct political contributions donations or payments on your tax return. The IRS makes it clear that you cannot deduct contributions that you make to any organizations that arent qualified to. The same goes for campaign contributions.

Contributions Or Donations That Benefit A Political Candidate Party Or Cause Are Not Tax Deductible. To be precise the answer to this question is simply no. You can deduct only unreimbursed employee expenses that are paid or incurred during your tax year for carrying on your trade or business of being an employee and ordinary and necessary.

Political contributions deductible status is a myth. No political contributions are not tax-deductible for businesses either. It further specifies that any amount paid or incurred for election reasons.

Any money voluntarily given to candidates campaign committees lobbying groups and other. Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income. A company or a corporate firm can claim tax deductions for the amount.

However the IRS law on political denotations is clear.

/tax-deduction-for-charity-donations-3192983_FINAL-9f9aa78932ec47ac960c8bacad155a17.gif)

Tax Deductions For Charitable Donations

The Ultimate List Of Tax Deductions For Shop Owners In 2020 Gusto

2022 Icpas Tax Guide For Members Of The Illinois General Assembly

Are Political Contributions Or Donations Tax Deductible The Turbotax Blog

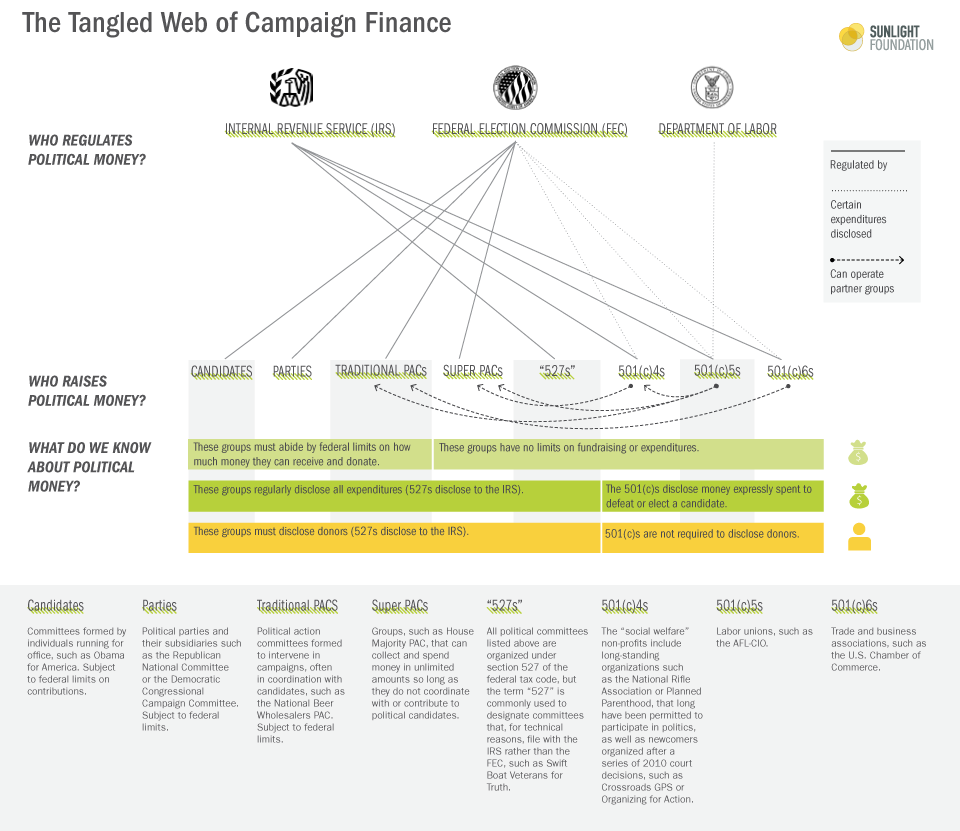

Campaign Finance In The United States Wikipedia

Daniel Hemel On Twitter In One Case It S Climate Philanthropy In Another It S Dark Money Note That The Phrase Dark Money Never Appears In The Patagonia Story Https T Co 4jmkbdwmcj Https T Co Ynz8ogkuol 6 6 Twitter

Is Your Political Donation Tax Deductible Wsj

Are Political Contributions Tax Deductible Anedot

Are Political Contributions Or Donations Tax Deductible The Turbotax Blog

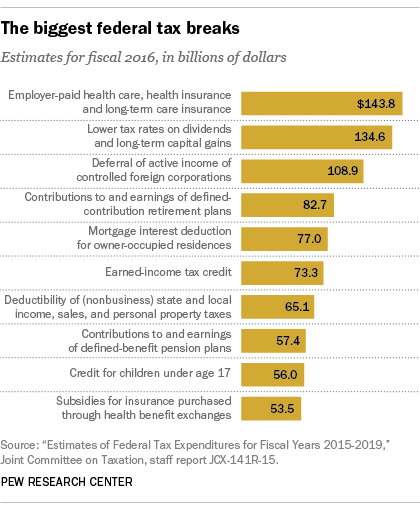

The Biggest U S Tax Breaks Pew Research Center

Why Political Contributions Are Not Tax Deductible

Are Political Contributions Tax Deductible Tax Breaks Explained

Are Marketing Expenses Tax Deductible A 2022 Update

Are Political Donations Tax Deductible

Small Business Tax Deductions 22 Money Saving Tips 2022 Shopify Indonesia